The strategic-beta ETF market has reached maturity in Europe with asset managers continuing to focus on other product areas such as ESG and thematics, according to a Morningstar report.

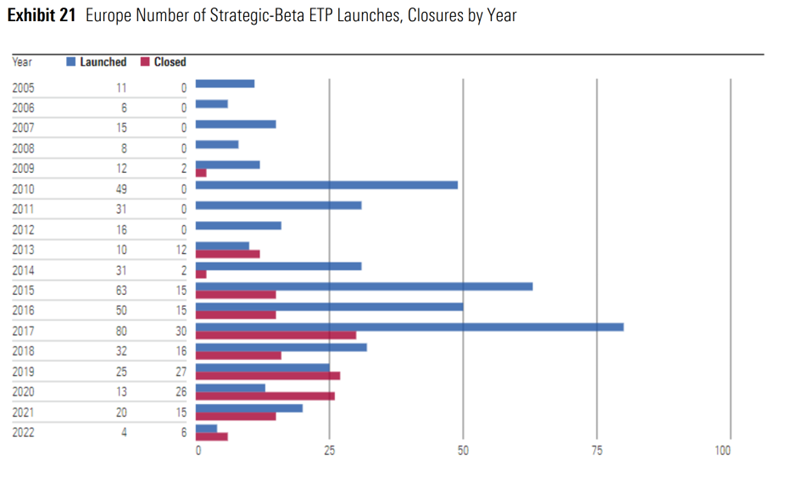

The report, Global Guide to Strategic-Beta ETPs, found both launches and closures have slowed down over the past four years, with shuttered ETFs outpacing newly launched strategies at 74 to 62, respectively, since 2019.

Last year, just four strategic beta ETFs were launched, the largest of which was the $872m iShares S&P 500 Equal Weight UCITS ETF (EWSP), with the other three failing to gather more than $20m each. Meanwhile, six strategic-beta ETFs closed.

Reflecting this, the market share of strategic-beta products in Europe is 6.8%, down from over 8% in 2019. Compartively, the asset class’s market share in the US is 20.9%, although it is worth noting this is also down on its 2019 peak.

Monica Calay, author of the report and director for passive strategies at Morningstar, said: “From 2013 to 2021, there was an uptick in closures, but in 2022 this pattern took a turn when the closure count dropped to just six.

“This is a natural consequence of the strategic-beta ETP market in Europe reaching maturity. It also shows how asset managers' product development efforts have shifted to other areas such as ESG and thematic funds in recent years.”

Source: Morningstar Direct

Sustainable ETFs, and more recently thematics, have taken precedence over strategic-beta ETFs for European investors in recent years, with the market share of the former much higher at 20%.

Despite this, sustainable strategies have failed to strategic-beta ETFs, with European-domiciled sustainable strategic-beta ETPs constituting only 8.5% of the total strategic-beta ETP market, according to Morningstar.

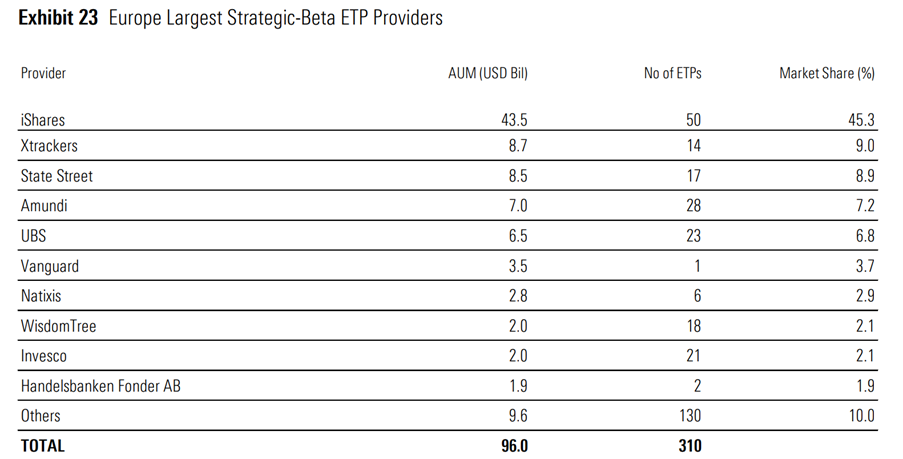

iShares dominates Europe

The European strategic-beta market continues to be dominated by BlackRock’s iShares, which had a 43.3% market share at the end of 2022, with its Edge-branded suite laying claim to six of the top 10 largest strategic-beta ETFs.

DWS and State Street Global Advisors (SSGA) are the second and third largest in the category, with a market share of 9% and 8.9%, respectively.

A large portion of their assets under management can be attributed to two ETFs, the $3.1bn Xtrackers S&P 500 Equal Weight UCITS ETF (XDEW) and the $4.8bn SPDR US Dividend Aristocrats UCITS ETF (UDVD), the largest strategic beta ETF in Europe.

Source: Morningstar Direct

While strategic beta may be showing signs of maturity in Europe, there are signs that other regions are embracing the strategy.

The number of strategic beta ETFs grew by 1.8% in 2022, mainly down to new launches in the Asia-Pacific region, according to Morningstar Direct. The region’s market share rose from 5-5.4% last year, driven by uptake in Taiwan and Australia.

Investors poured $161.2bn into the ETFs globally in 2022 – an organic growth rate of 9.8% – taking total assets to $1.5trn.

Calay added: “More recently, the space has matured in the US and Europe. The category's market share gains have stalled, and closures of products that have not gathered assets have been a common theme.

“In the Asia-Pacific region, on the other hand, net flows and product launches both picked up in certain markets in 2022.”