Some socially responsible investing (SRI) ETFs offer higher risk-adjusted returns than their traditional ETF counterparts, research conducted by analysts at Société Générale has found.

The report, entitled Shades of green: A review of SRI ETFs and 50 underlying benchmarks, first looked at the different ways index providers were constructing their SRI indices.

Although the indices differed widely in terms of SRI approaches and index methodologies, the analysts found all index providers had the same goal of minimising deviations from their parent indices while maximising environmental, social and governance (ESG) ratings.

In particular, some 58% of the indices studied had some explicit constraints defined in their rules to limit potential deviations from their parent indices.

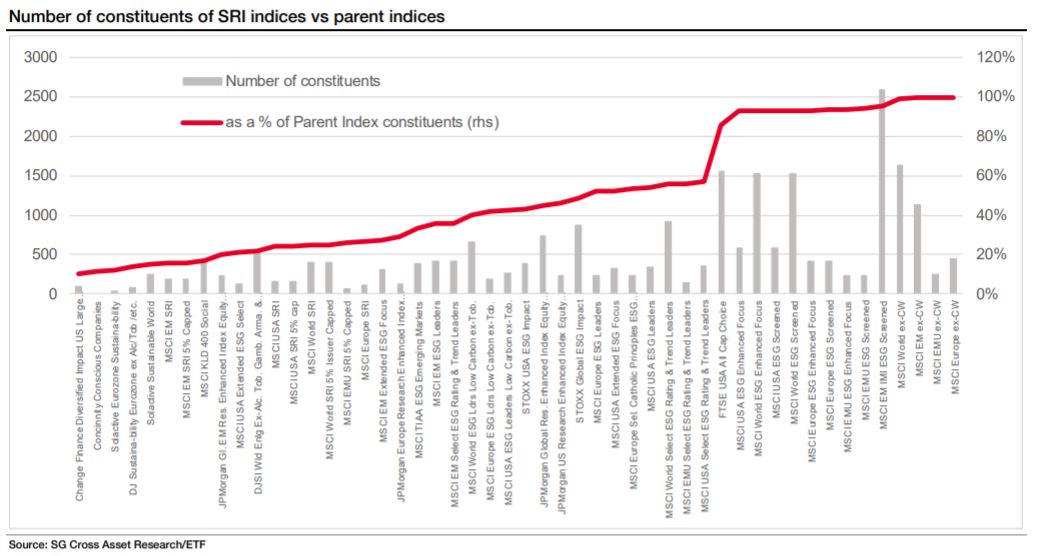

However, there was a wide divergence among SRI indices in terms of the number of constituents in the SRI index as a percentage of the number of constituents in the parent index.

In terms of sector biases versus the parent indices, the report calculated limited divergences from the traditional benchmarks, highlighting the index providers’ aim of not moving too far away from parent indices.

Sébastien Lemaire, head of ETF research at SocGen and co-author of the report, commented: “As such, SRI indices usually show minimal deviations from their parent indices, whether they mention explicit constraints in their index rules or not.

“We believe this may not be a coincidence but rather an intended goal.”

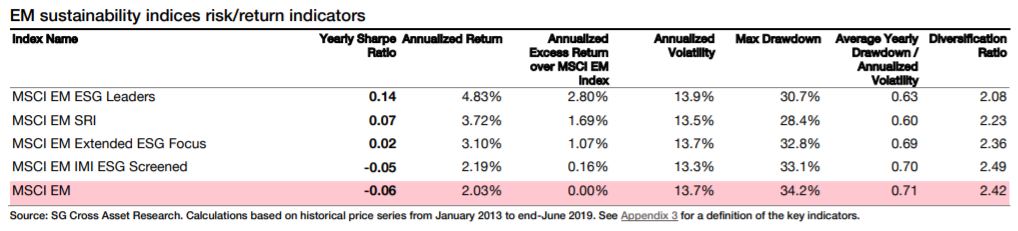

Because of the limited divergence away from parent indices combined with strong ESG ratings, the report said SRI indices do not deteriorate the risk-return profile of traditional indices.

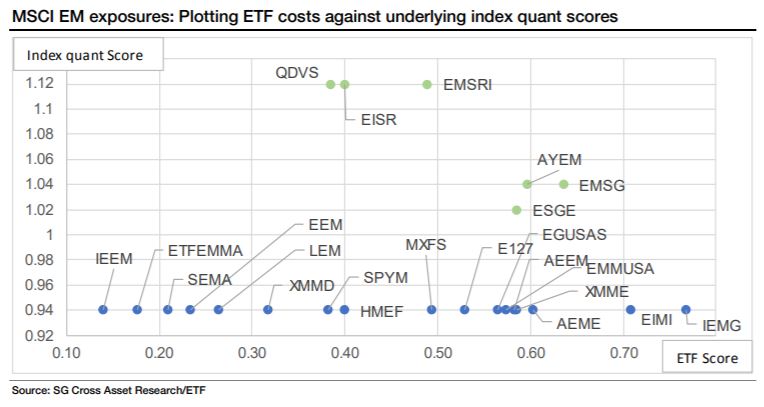

Furthermore, in emerging markets, in particular, SRI indices, such as the MSCI EM Leaders index or the MSCI EM SRI indices, saw an improvement in the risk-adjusted return profile but this was limited in the US.

Lemaire added: “Our results show that almost all SRI indices enjoy higher ESG ratings with relatively similar risk-return patterns to their parent indices.”

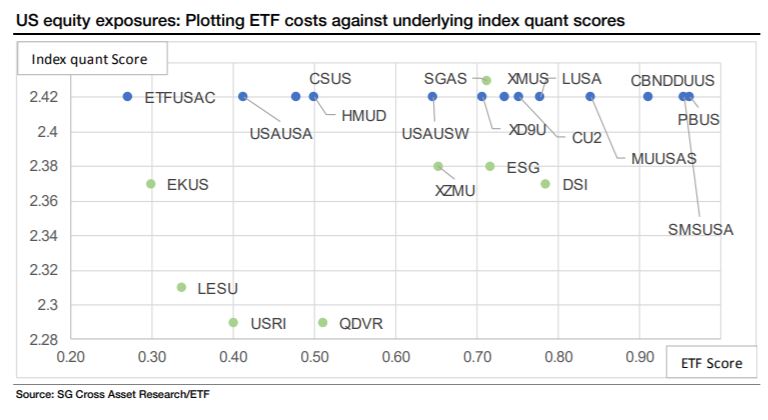

In order to measure whether this translated to SRI ETFs, the SocGen analysts compared the total cost of SRI ETFs to non-SRI ETFs.

The report noted some SRI ETFs could have lower TERs versus their non-SRI counterparts, especially in emerging markets.

Overall, the SocGen analysts found this was particularly prevalent for world, eurozone and emerging market ETFs and less so for the US.

For example, the Xtrackers ESG MSCI World ESG UCITS ETF (XZW0) and the iShares MSCI World ESG Screened index (SNAW) could be attractive alternatives to MSCI World ETFs while the Xtrackers MSCI EM ESG Leaders UCITS ETF (EMSG), the iShares MSCI EM IMI ESG Screened UCITS ETF (AYEM), the iShares ESG MSCI EM ETF (ESGE) and the Amundi index MSCI EM SRI DR UCITS ETF (EMSRI) could be alternatives to MSCI EM ETFs.

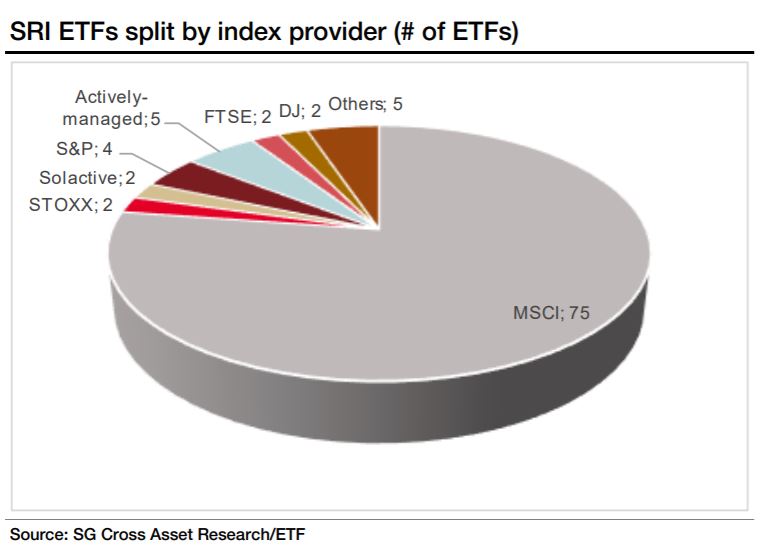

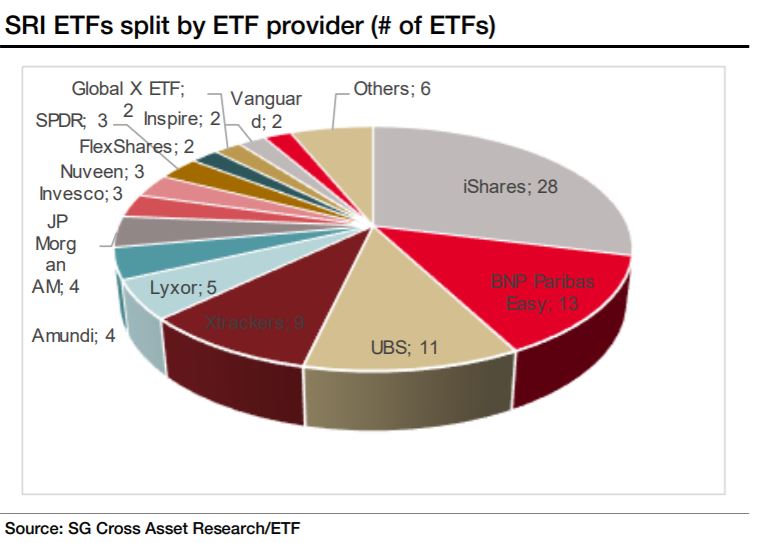

There are currently 90 SRI ETFs listed in the US and Europe, excluding impact investing, thematic and factor ETFs.

Competition among ETF issuers is “intense” but is still concentrated with iShares offering 28 products, BNP Paribas running 13 and UBS managing 11 of the 90 ETFs. MSCI dominates the index provider space, running over 75% of the ETFs available.