Facebook, Apple, Amazon, Netflix and Google (FAANG) are known to be the most dominant and popular tech companies in the market, showing exceptional growth, performance and revenue. The term FANG was originally coined by Jim Cramer back in 2013, before the inclusion of Apple. This was six years ago so how are the five companies faring now?

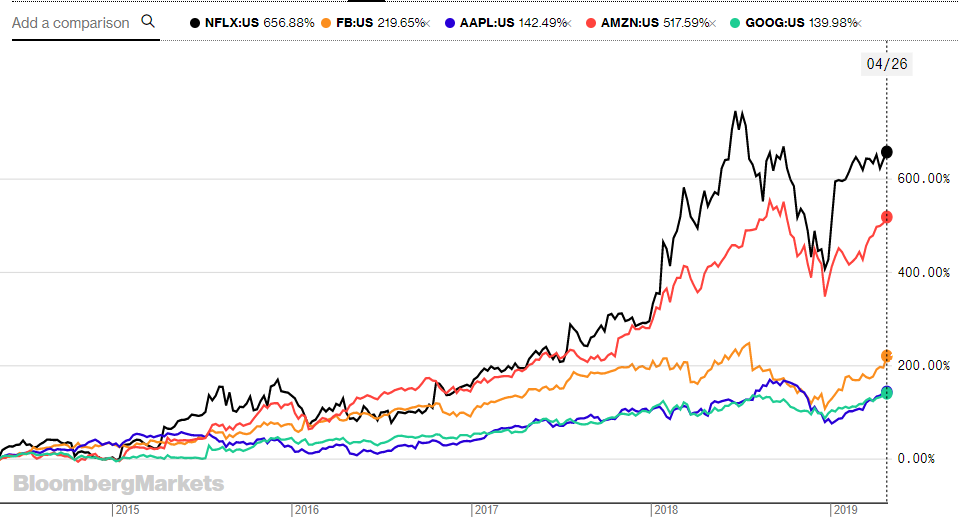

FAANG’s 5-year returns – Source: Bloomberg

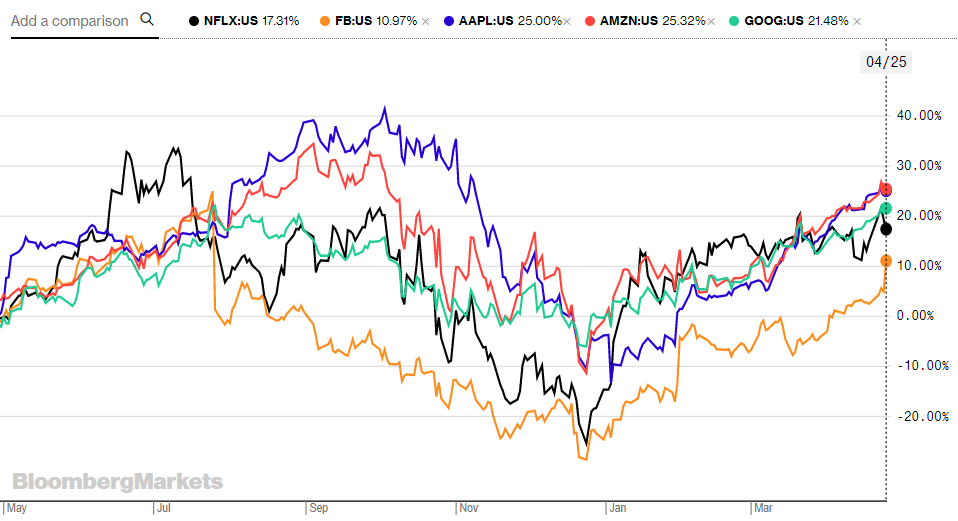

FAANG’s 1-year returns – Source: Bloomberg

Over the five-year period, Netflix and Amazon have been the biggest returners offering 656.9% and 517.6%, respectively. Despite a detrimental Q4 2018, all five stocks have still produced double digit returns over the last 12 months. Most noticeably Amazon and Apple offering 25.3% and 25%.

This year has already brought less than positive news for several the stocks such as Disney pulling its partnership with Netflix to launch its own competitive platform as well as Apple’s sales this year expected to disappoint.

CompanyQ3 ’16 – Q3 ’17 ReturnsQ3 ’17 - Q3 ’18 ReturnsFacebook29.7%26.3%Apple58.8%22.4%Amazon38.8%63.1%Netflix65.9%117.9%Google35.1%14.7%

Source: Bloomberg

As the later half of 2018 was difficult for the whole of the equity market, we wanted to compare the stocks’ year-on-year performance prior to the dip to the previous year. Facebook, Apple and Google all had a better Q3 2016 – Q3 2017 compared to Q3 2017 – Q3 2018, producing greater returns. However Amazon and Netflix, online streaming platform competitors, had a better Q3 2017 – Q3 2018.

Despite Netflix’s strong performance over the last five years, it holds the smallest weighting in the SPDR S&P 500 ETF (SPY) with only 0.67%, behind Disney with 0.97%. Apple holds the largest weighting with 3.80%. Amazon, just behind, has 3.22%, Facebook 1.78% and Google 1.58%.

Despite being popular enough stocks to be named in its own elite group, none of the five stocks hold the largest weighting in SPY. Microsoft, which just broke through the $1tn market cap barrier holds the largest weighting of 3.93%.

Microsoft has a five year growth of 226.6%, greater than Facebook, Google and Apple, and a one year growth of 37%, greater than all five FAANG stocks.

Discussing this in more detail, ETF Stream is hosting the Big Call: Technology Funds event where we will go in more detail about the future of FAANGs and what else could be the next big thing.