Short-duration US Treasury ETFs are set to play an instrumental role in diversifying crypto lender MakerDao’s stablecoin reserve composition.

MakerDao has selected crypto bank Sygnum as the lead partner in its $500m treasury diversification into traditional assets to help improve the stablecoin’s balance sheet.

As part of the first phase of the strategy, Sygnum is partnering with the Swiss arm of BlackRock to invest $250m into the iShares $ Treasury Bond 0-1yr UCITS ETF and the iShares $ Treasury Bond 1-3yr UCITS ETF.

Ed Gordon, head of iShares and wealth in Switzerland and co-head of EMEA wealth leadership team at BlackRock, said: “We are pleased to work with Sygnum on this innovative solution that demonstrates the versatility of fixed income ETFs.

“This project illustrates how BlackRock's portfolio analytics, risk management and asset allocation capabilities can be applied using the ready tradability of fixed income ETFs.”

The decision to diversify their treasury comes as MakerDAO, the company behind the DAI stablecoin, is trying to boost its balance sheet's profitability.

Currently, the lack of yield-bearing USDC tokens present in its $10.5bn collateral pool are not “strengthening” the firm enough, the report suggested.

Fundamentally, MakerDAO is looking to change its DAI stablecoin's reserve composition following a slew of regulatory announcements.

Under the newly accepted markets in crypto assets (MiCA) laws passed by the European Council yesterday – or any of the stablecoin bills proposed to Congress in the US – DAI would not meet any of the regulatory reserve requirements.

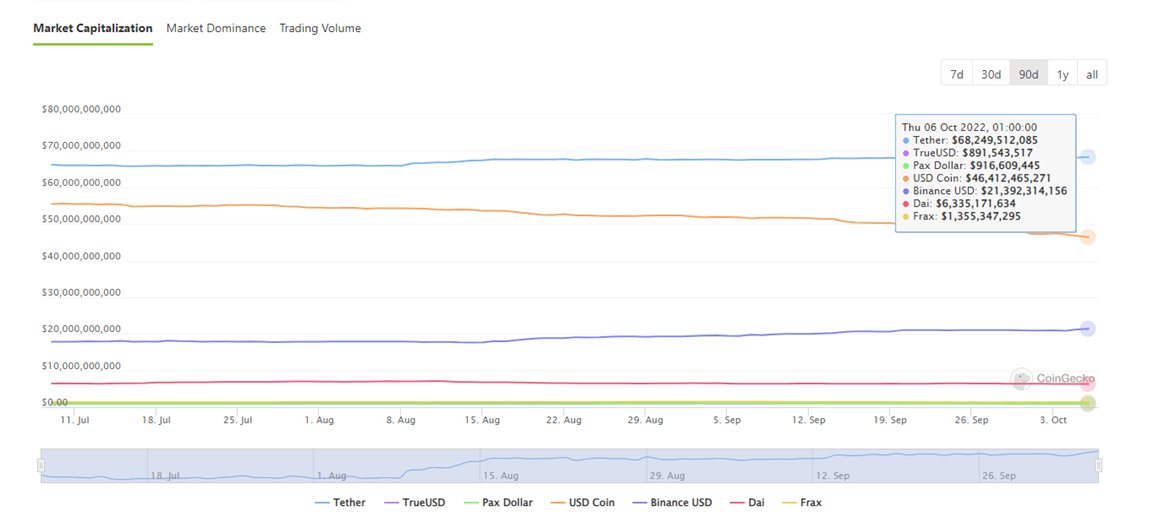

Currently, DAI is collateralised by 18 different cryptocurrencies including ethereum, USDC and USDT to name but a few and is the fourth largest stablecoin by market capitalisation ($6.3bn), data from CoinGecko has suggested.

Source: CoinGecko

In both the EU and US, algorithmic stablecoins like terraUSD are expected to be fully banned, with stablecoins holding reserves in fiat currency and backed on a one-to-one basis most probably the only types of stablecoins allowed to operate in both jurisdictions.

Based on reserve requirements only, stablecoins like Circle's USDC and Binance's BUSD could potentially operate in the US and EU, but market leader Tether (USDT) and DAI could not.

The decision to appoint Sygnum, and its ETF-focused “new strategy”, was approved by 72% of the MakerDao community.

Martin Burgherr, chief client officer at Sygnum, said: “MakerDao's vote confirmed Sygnum as a 'crypto-native' bank. It is proof that traditional-crypto finance industry investments can flow both ways and that the future has heritage, especially when shaping next-generation finance.”

Related articles