Rarely do using sporting analogies carry much weight in the world of finance, however, on this occasion, the idea of the boxer on the ropes certainly springs to mind when it comes to the value factor and its woeful performance over the past decade. Value took punch after punch by academics and investment professionals alike with some even calling the death of the renowned factor.

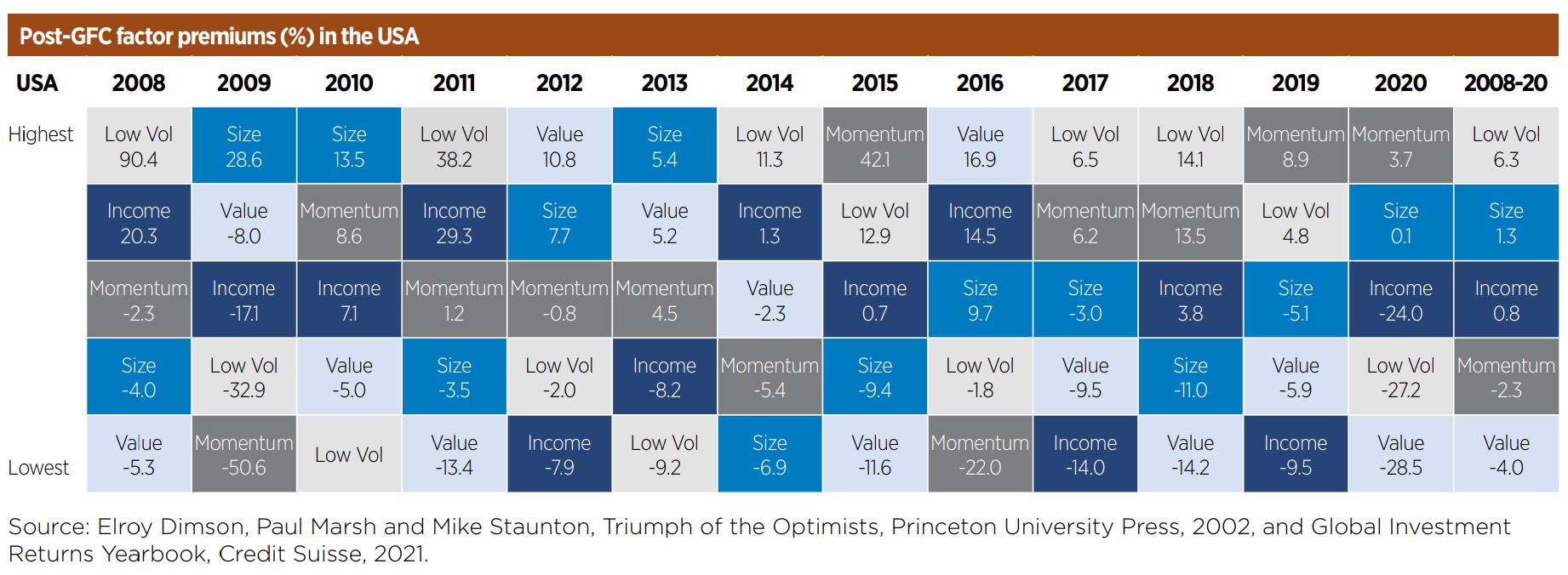

Highlighting this, according to research conducted by Elroy Dimson, Paul Marsh and Mike Staunton, the value premium has delivered returns of -4% in the US between 2008 and 2020, the worst across all factors, with low volatility soaring 6.3% over the same period.

But what drove markets to this point? The low interest rate environment driven by the vast amounts of quantitative easing flowing through the global economy. And more recently, Rob Arnott, founder and chairman of Research Affiliates, said the underperformance, especially during the rapid spread of coronavirus in March 2020, was primarily sentiment driven.

“Value stocks are much less shiny and glamourous compared to market darlings like Tesla. In the current COVID-19-driven environment, the contrarian positioning of value stocks feels especially risky and scary,” Arnott continued. “Extreme underpricing of value stocks relative to their fundamentals, combined with much greater retail participation in momentum trading, has sharpened the contrast between value and growth stocks. This heightened divergence is likely a more reasonable explanation for the current deep discount rates than is the expectation of the lower profitability of value companies.”

To take the boxing analogy a step further, the Pfizer vaccine was certainly the jab value needed to get it back into the fight and has been the catalyst for what has been a remarkable comeback over the past five months. Literally overnight, value stocks started to outperform amid positive news the vaccine would enable countries to emerge from nationwide lockdowns. Following the vaccine news, the Russell 1000 Value index outperformed the Russell 1000 Growth index by 6% on 10 November, the highest daily excess return over the past decade, highlighting the dramatic rebound in the beleaguered stocks.

Since then, value has torn away with the Lyxor Russell 1000 Value UCITS ETF (RUSV) climbing 13.4% since the start of the year, as at 18 March, versus just 0.4% returns for the Lyxor Russell 1000 Growth UCITS ETF (RUSG). The flows have followed with investors piling some €4.3bn inflows in the four months to 25 February, according to data from Bloomberg Intelligence, a monster swing in sentiment following the €160m outflows seen between July and November 2020.

The reason behind the dramatic reversal in flows is relatively simple. The current prevailing sentiment is if the coronavirus vaccine is rolled out across the globe and inflation picks up then cyclical sectors such as financials and energy should outperform the market.

As Russ Mould, investment director at AJ Bell said: “If a COVID-19 vaccine is quickly and successfully distributed, then stocks which are seen as ‘immune’ from the pandemic may be less in demand and seen as less worthy of a premium valuation. Equally, if growth and inflation pick up, then investors may not be so inclined to pay such premium multiples for ‘growth’ companies, if rapid earnings increases can be acquired much more cheaply along with downtrodden value, cyclical plays like industrials, financials and consumer discretionary plays.”

But how long can value’s outperformance continue? The answer most likely is value still has a long way to run simply due to the decade-long underperformance it has suffered. As a recent JP Morgan research note stressed: “Value, on the other hand, is still attractive, and trades not far from multi-year lows. We focus our longs on banks and on the consumer reopening trade, and would potentially look for a general fading of risk-on internals stance sometime nearer Q4, once the acceleration in activity and in inflation is behind us, as well as when the bulk of the tailwind from fiscal stimulus is done.”

So how should ETF investors play this ongoing rally in value stocks? It is well documented how not all ETFs are created equally and two strategies with the same “value” label can have very different drivers of performance. Taking RUSV which tracks the Russell 1000 Value index. As highlighted above it has delivered returns of 13.4% this year while the iShares Edge USA Value Factor UCITS ETF (IUVL) has jumped 21.8% over the same period.

Have ETF investors missed the value trade?

While RUSV tracks a basket of 849 stocks, IUVL has a far more concentrated allocation of 148 currently meaning it will have a more intense exposure to the value factor, especially during periods when value is rallying. On the flipside, RUSV will deliver stronger returns in periods of underperformance for value due to its diversification benefits. For investors, understanding these nuances is crucial when assessing which strategy will best suit their portfolio.

As Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence, said: “It is a two-step process. Investors need to get the factor right but also the individual right as well. Labels tell investors very little about the ETF. As you can see, there are stark differences in construction and methodologies.”

This article first appeared in the Q1 2021 edition of Beyond Beta, the world’s only factor investing publication. To receive a full copy,click here.